Chaikin Oscillator- An Overview

In the world of stock trading, technical analysis is an essential tool for all traders. It helps investors to analyze market trends and make reliable investment decisions. One of the best technical analysis tools used by traders globally is the oscillator. An oscillator is a technical indicator used by investors to track securities' momentum or trend. In stock trading, the Chaikin Oscillator is a popular oscillator used by traders to gauge the health of the stock market. In this blog, we will discuss Chaikin Oscillator, its popularity in stock trading, and how it can be used as a tool for analyzing the stock market.

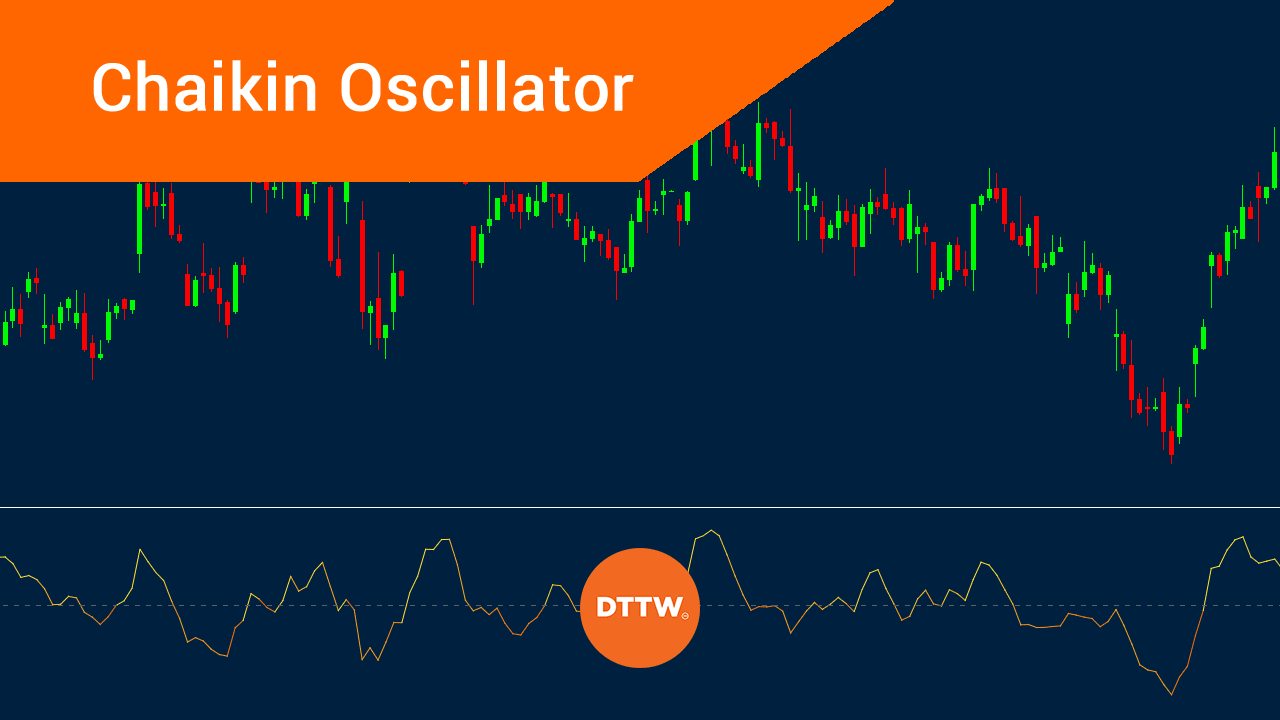

What is the Chaikin Oscillator?

Developed by Marc Chaikin, the Chaikin Oscillator is a widely used technical indicator that helps traders analyze securities' momentum. The oscillator is a type of volume indicator that uses the Accumulation Distribution Line (ADL) to determine the strength of the market. Accumulation Distribution Line calculates a cumulative volume flow for a security and is used to gauge where the money is flowing in or out of the security. The Chaikin Oscillator then uses this data to identify bullish or bearish trends in the stock market.

How does the Chaikin Oscillator work?

The Chaikin Oscillator is calculated by subtracting the 10-period exponential moving average (EMA) of the Accumulation Distribution Line from its 3-period EMA. The resulting value is plotted as a histogram, which moves above and below a zero line. When the histogram is above the zero line, it indicates that the security is in a bullish trend, and when it is below the zero line, it indicates a bearish trend. The size of the histogram also indicates the strength of the trend. The bigger the histogram, the stronger the trend.

Using the Chaikin Oscillator as a tool for analyzing the stock market

The most significant advantage of the Chaikin Oscillator is that it can help traders identify trends in the stock market. By analyzing the histogram's size and movement, traders can determine whether the market is bullish or bearish. If the histogram is showing a consistent increase or decrease, it indicates that the stock is in a strong trend. Moreover, the Chaikin Oscillator can also be used as a tool for momentum trading. For instance, if the oscillator shows a bullish trend on a stock, traders can use it as an indication to buy the stock.

Conclusion

In conclusion, the Chaikin Oscillator is a powerful tool that helps traders analyze the stock market. It is an essential technical indicator for traders who want to make informed investment decisions. The oscillator is particularly useful for traders who want to identify trends in the market and use them for their trading strategy. By analyzing the oscillator, traders can also determine if the market is bullish or bearish. It is a most useful technical indicator for short-term traders who want to capitalize on short-term price movements. If you are interested in using the Chaikin Oscillator in stock trading, remember that it is only one of many tools available to traders. It is essential to integrate the oscillator with other technical indicators for better market analysis.